Payroll & Finance

Why Payday Filing is a positive change for small businesses

January 16, 2019

Payday Filing is currently being rolled out nationwide, with the deadline of April 2019. That means in just over 3 months, almost all NZ business owners will need to file their PAYE information within two days of paying employees. And despite what you may have heard from some business owners and other payroll companies, this is a good thing.

IRD will be able to receive tax information more quickly and accurately, providing your employees more certainty about their tax obligations and entitlements. But more importantly, when implemented properly, payday filing will actually make your payroll process easier. If you’re using the right payroll software, tax filing becomes part of your usual payroll process rather than an extra monthly step.

Payday Filing replaces the previous procedure of sending in the information once a month in an employer monthly schedule. You must do payday filing electronically if your annual PAYE or ESCT deductions are more than $50,000. As a result, some small business owners are legitimately concerned about having to file information more frequently. And for those who choose to do it manually, that will be the reality.

But there is no need to lose sleep over this change. IRD has massively upgraded their systems and for the first time ever online payroll systems can send PAYE information directly to IRD. It means payday filing can be super simple if you use the right software. It becomes a fully automated process and one less administrative task to deal with.

Dignity – Social Enterprise

“I don’t know why you’d burden yourself with a process that some software can already do for you. It’s one less thing that I need to do while running a company and lets me focus on things that matter.”

But make sure you do your homework! There are three different ways that you can set up payday filing:

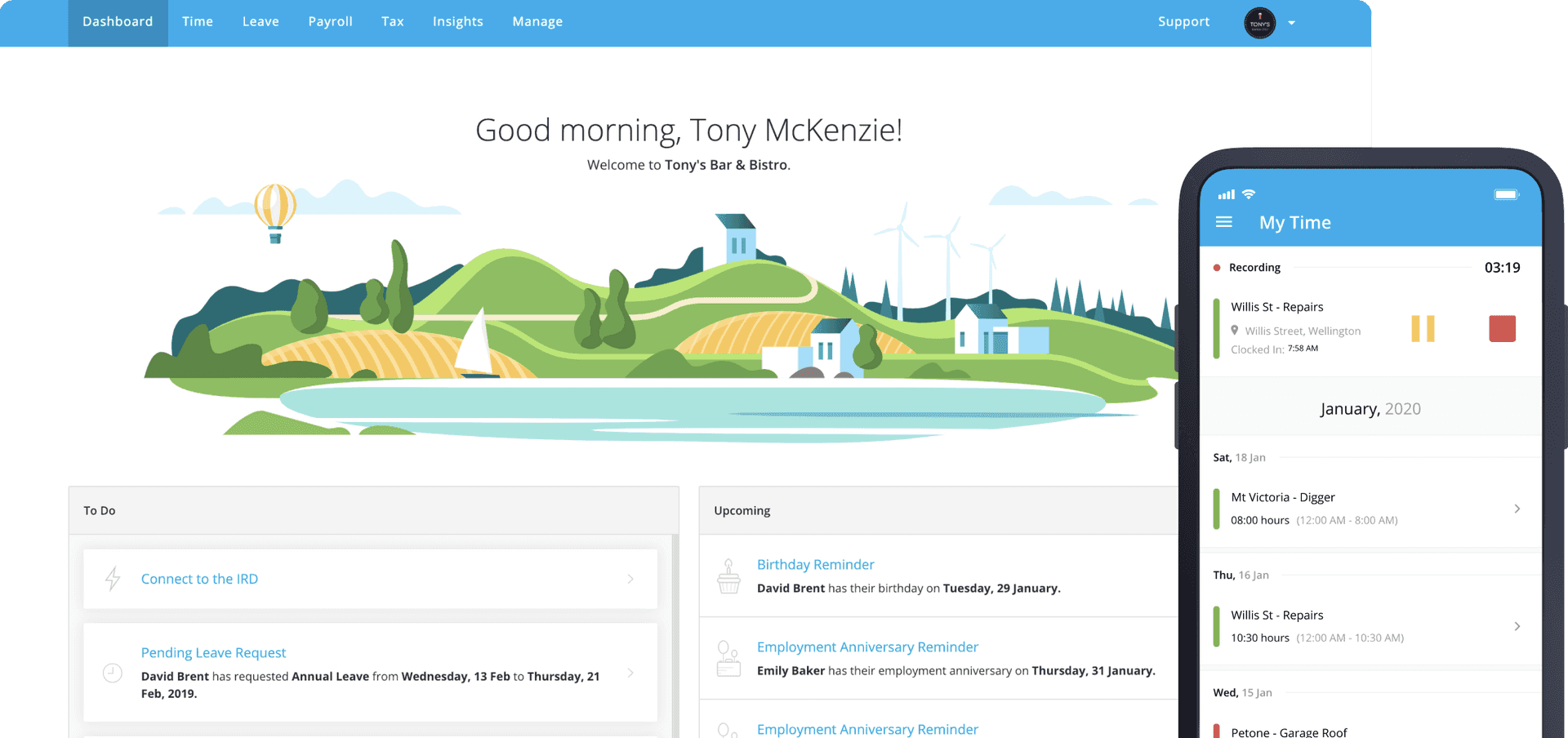

Fully automated, zero touch – this the easiest, most pain-free way to set up payday filing and is what we provide at PayHero. You’ll simply need to establish a link between your software and IRD through myIR as a one-off authorisation process, and that’s it. From then on your payroll information will be sent to IRD automatically on each payday. This is done via a direct integration with IRD, sometimes referred to as gateway services, or B2B filing.

Download/Upload approach – Some payroll providers will technically be compatible with payday filing, but it won’t be automated. When you run a pay you’ll have to download a Payroll Information file and then login to myIR to upload it.

Manual entry to myIR – The third and most time consuming approach is to manually enter payroll data into myIR every payday.

It’s important for you to know which payday filing option you’re going to use and when you’ll implement this. If you’re using software that will be payday filing compatible, ask them exactly how it will work. It’s best to organise yourself well before April and not leave it till the last minute in case things don’t run as smoothly as hoped, because this will be a very busy time of the year for everyone, including payroll providers and IRD. You wouldn’t want to find yourself on the wrong end of a fine from IRD if you don’t get it right.

Ultimately, yes the introduction of payday filing is a big change and change can sometimes be scary. For some employers, it may increase their administration effort and add compliance costs. However, it’s also an opportunity to make PAYE filing simple and automated and something you never need to think about again. FlexiTime is here to make it as pain-free as possible and provide a seamless transition for you.