Payroll & Finance

How compliant is your payroll? Questions to ask yourself (or your payroll provider).

September 2, 2020

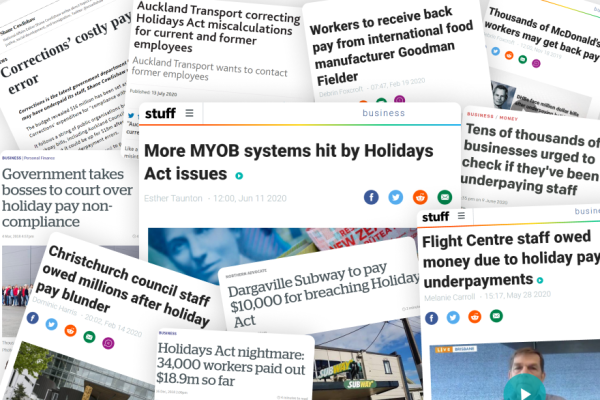

If you’ve been keeping half an eye on the news over the last few years you will have seen multiple stories about companies having issues with the Holidays Act 2003. Many large organisations, including government departments, have reported underpayments in employees’ historical holiday payments.

More recently the focus has switched to small and medium sized employers, after MYOB announced they have discovered issues with their suite of payroll products.

The unfortunate truth is that these compliance issues are widespread and will affect most payroll providers in New Zealand.

Generally, Holidays Act compliance is pretty straightforward if your employees are salaried or work consistent hours from week to week. Where it can get trickier is if you have employees who work variable hours or whose work patterns change over time.

Are you wondering if your current payroll setup is compliant? Here are a few questions to ask yourself (or your payroll provider if you're unsure). If you’re not satisfied with any of the answers and want to switch to a payroll provider that takes compliance seriously - get in touch.

Are you correctly measuring gross earnings?

One of the most common payroll errors is excluding payment types from an employee’s gross earnings, which then reduces the value of their leave. Bonuses (aside from rare purely discretionary bonuses), commissions, overtime, allowances, even the cash value of board and lodgings all should be included in gross earnings. Your payroll system should make it easy to get this right.

Are your employee leave balances kept in weeks?

This is the most important question and the easiest to answer. The Holidays Act provides employees with four weeks of annual leave for each year of continuous employment, regardless of the number of hours worked in the previous year.

The most likely reason a business may be non-compliant is because they’re using a payroll system that “accrues” annual leave based on hours or days actually worked, or on a fixed ‘normal hours per week’ agreed when the employee first started.

According to the Ministry for Business, Innovation & Employment (MBIE) -

Many payroll systems run an ‘accrual’ balance, either on its own or in tandem with the entitlement balance. However, there is no concept of ‘accrued holidays’ in the Act, and care should be taken with ‘accrual’ balances. While they may be useful as an estimate of an employee’s entitlement (and an employer’s liability), they can often lead to non-compliance (especially if the accrual balance is in units other than weeks).

So if your payroll system accrues leave and stores it in hours or days, you’re potentially at risk unless you do a bunch of manual recalculations every time an employee’s work pattern changes.

How many weeks of leave do your employees have right now?

If your payroll system stores annual leave balances in days or hours, how do you know how many weeks of leave each employee has? Remember, the legal entitlement is for four weeks of annual leave a year. If you don’t know exactly how many weeks of leave any of your employees have right now, ask your payroll provider to tell you. If they can’t do that, it might be time to look for a more compliant payroll system. As MBIE states in their 2017 guidance document: “it is strongly advised that annual holidays balances are kept in weeks.”

If your employees have variable hours and/or days, how do you ensure they correctly receive 4 weeks of leave when their work pattern is constantly changing? When an employee takes leave, how do you figure out what proportion of a week that leave is for and what rate to pay?

Wherever possible, the definition of a week for the purposes of annual leave should be agreed between the employer and employee. Ideally it should be recorded in the employment agreement.

In some situations however, the working week for an employee will be constantly changing. One option MBIE offers in this situation is to use a recent review period to determine what constitutes a week. A good payroll system will be able to ease the effort in doing this.

Do you have a complete wage record, including the number of hours worked each day, and evidence of rest and meal breaks?

As an employer, you must keep wage and time, and holidays and leave records that comply with the Employment Relations Act 2000 and the Holidays Act 2003.

According to MBIE, these recordkeeping requirements are needed to show a clear picture of each day in an employee’s working year.

“That is, which days were worked, not worked, on leave and what type of leave, and so on. This information is used to calculate different types of pay for such leave as annual holidays or sick leave, and entitlements such as parental leave.”

Some payroll systems only record the total hours for a week, without a record of how many hours were worked on each day. Unless you have this information in a separate time and attendance solution, or are keeping boxes of paper timesheets stored away somewhere, that’s not enough information to comply with the legislation.

As well as that, when it comes to paid and unpaid breaks, you need to keep a good record of those as well to show you’ve been meeting your employer obligations. Read our Q&A on New Zealand’s rest and meal break rules.

Can you be sure that employees who have changed their work patterns maintain their sick leave entitlements?

The sick leave entitlement is 10 days a year. That applies to everyone who meets the minimum threshold. If you work 3 days a week, you still get 10 days of sick leave per year.

If sick leave balances are held in units other than days then you may be short-changing your employees if their hours per day change. As with annual leave, ensure the units in which sick leave balances are held match the Holidays Act.

Are alternative holidays paid out using the relevant rate when the leave is taken, irrespective of what was worked on the public holiday?

As with sick leave, alternative holidays need to be recorded in days. It is irrelevant how many hours an employee worked on the public holiday when they were given the alternative day.

When they take the alternative day off they are paid what they would have been had they worked that same day, NOT the hours they worked on the public holiday. If your payroll system is recording alternative leave in hours then there is a good chance this is being done incorrectly.

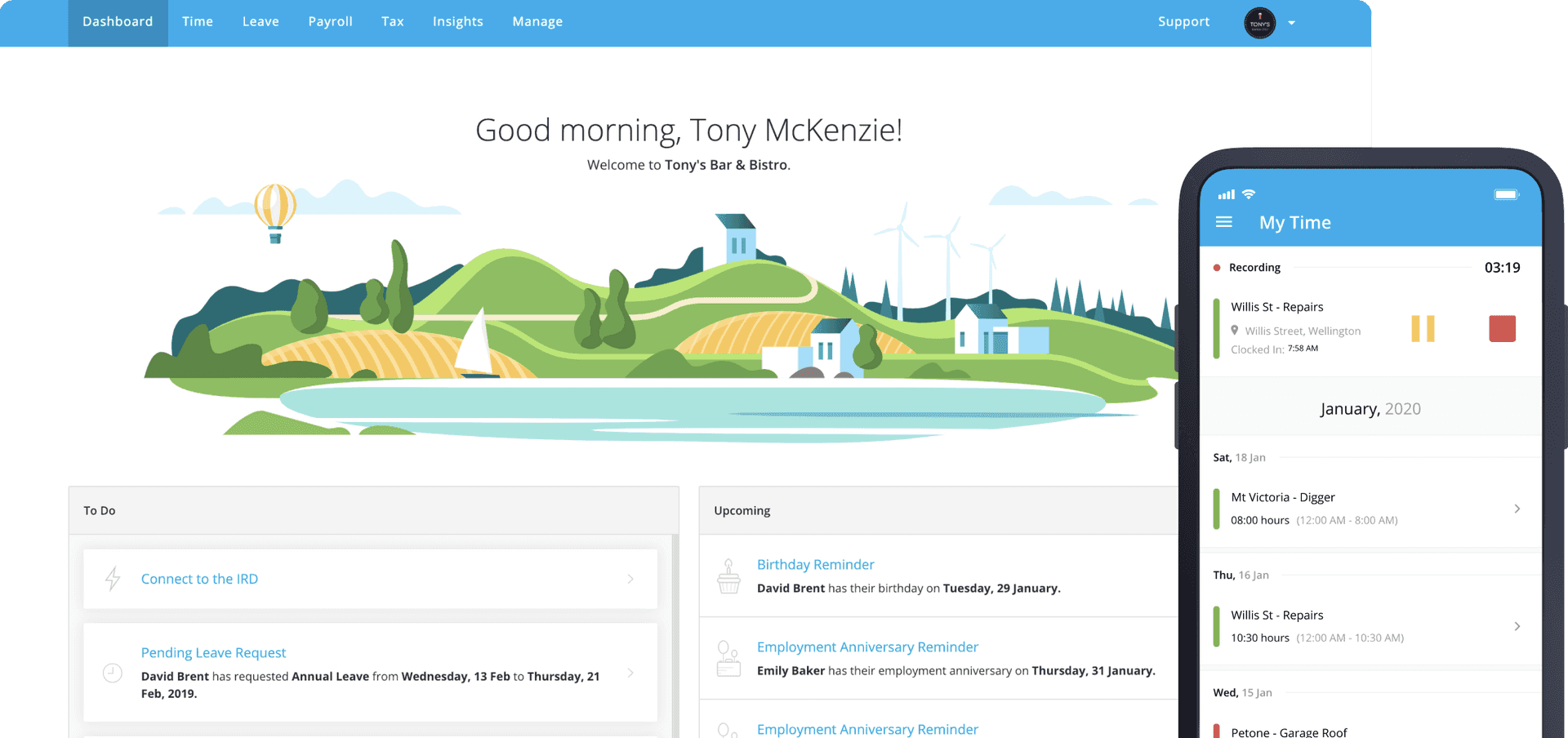

Pay Employees Right with PayHero

We’re committed to helping our customers pay their staff correctly for holidays and making it as easy as possible to comply with the Holidays Act.

We built PayHero to handle employee leave using the latest guidance from MBIE. We’ve also built plenty of smarts into the system to make it easier for companies with staff who work variable hours or have changing work patterns to get their leave entitlements correct.

Find out more about our approach to payroll compliance.