Payroll & Finance

Understanding New Zealand’s payroll compliance nightmare

August 13, 2020

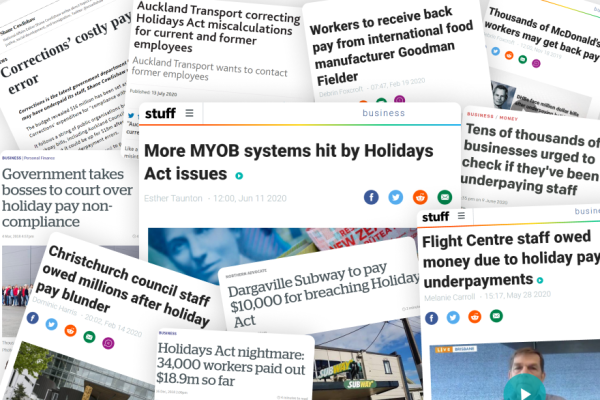

With Australian company MYOB notifying small businesses recently of problems with how its New Zealand payroll products calculate employee leave, the Holidays Act compliance nightmare is no longer just a problem for large employers.

Widespread reports of Holidays Act remediation payments have hit the news recently, with large organisations and government agencies paying out millions of dollars to cover employee holiday underpayments.

However, these problems have never been exclusive to large companies - they’ve just been the ones in the spotlight so far. Unfortunately, most payroll systems being used by small to medium businesses in New Zealand today will have similar problems to MYOB when it comes to leave calculations.

As someone who has now developed two online payroll systems ten years apart, I am surprised at the slow response of payroll software providers to updated Holidays Act guidance from the government in 2017. This delay in updating systems leaves thousands of employees out of pocket and puts employers at risk of non-compliance.

A simple principle

The Holidays Act certainly has some complicated rules, however, at its core is one simple and very important principle - employees get four weeks of paid leave for each year of continuous employment.

Forget about how much is paid for those holidays, the principle is to give every worker four weeks each year to rest and recuperate and spend time with friends and whānau. When workers take those four weeks of leave they must receive what they would normally be paid if they were working.

Problems accrue

So how did so many get it so wrong?

Most payroll systems accrue leave as you go, either based on the hours actually worked each week, or on a fixed ‘normal hours per week’ agreed when the employee first started.

So if you’re working 10 hours per week over a year you’ll have accrued 40 hours which, as long as your work pattern doesn’t change, would allow you to take four weeks off. But if your work pattern does change and you’re now working 40 hours per week, those hours accrued in the previous year would only pay for one week of leave. The remaining three weeks may be given to you as leave, but how would you afford to take those three weeks off without any remaining holiday pay?

When a payroll system accrues leave based on hours worked it is up to the payroll administrator to ensure that leave balances are updated whenever an employee’s work pattern changes. Surprisingly most payroll systems don’t handle this automatically and unfortunately, most payroll administrators haven’t been applying those changes regularly.

Covid complications

The problems with the accrual method were only exacerbated during the recent COVID-19 lockdown. If you’re accruing leave on the hours an employee works, what happens when the employee is receiving a wage subsidy but not working?

Companies with casual employees who were not working during lockdown are finding that their employees haven’t been accruing leave toward their four week entitlement. This is a problem that may only become apparent when the employee takes leave at a future date.

A better solution

Because the law expresses the leave entitlement in weeks, payroll systems that also store leave in weeks ensure that when an employee’s work pattern changes the leave entitlement remains the same.

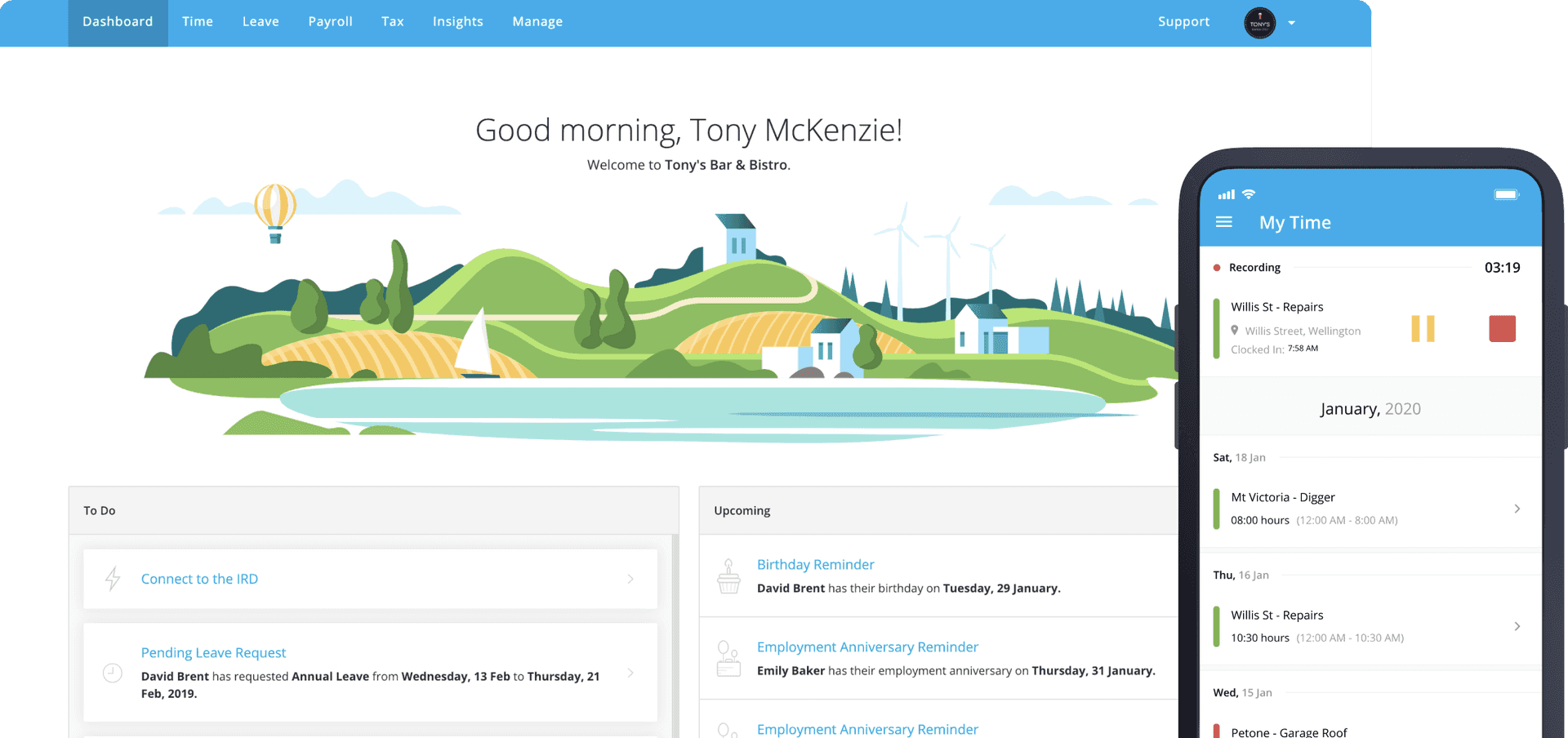

When MBIE released guidance on the Holidays Act in 2017 it was made clear that accruing leave based on hours worked could lead to non-compliance. At that time we decided to incorporate the guidance into the design of PayHero, our new NZ payroll system.

We’ve been working since then on explaining how annual leave should work and the importance of employees receiving their four week entitlement each year.

Taskforce review

In response to Holidays Act non-compliance identified by MBIE, a Holidays Act Taskforce was established in 2018 to review the Act and has since delivered their recommendations to the Minister for Workplace Relations and Safety.

There have been calls for a complete overhaul, but that’s unlikely now that so many government agencies and large corporates have spent millions of dollars rectifying historical issues and changing their payroll systems to comply with the law as it currently stands.

I’m not expecting dramatic changes from the review because the Act is fundamentally sound and fair. When your payroll system correctly stores leave entitlements in weeks you can be confident that changes to employees' work patterns won’t create issues of underpayment like we’ve seen recently.

I’m expecting the review will provide clarity and guidance for different types of employment scenarios to give employers and employees confidence that the correct entitlements are being calculated.

What now for employers?

While we wait for news about the review, one thing that’s certain is that even if changes are made, businesses should make sure that employee leave balances are correct and are updated to reflect the employees’ work patterns. MYOB has advised its clients to review the last six years of pay for every employee. That’s going to be quite a monumental task.

It’s not great timing either, coming after the recent business disruption due to COVID-19. Payroll systems should be built not only to apply the rules of the law correctly, but also to make sure that leave and pay records are kept such that any changes to historical information are easily applied.

Talk to your payroll provider to confirm whether you may be affected. If you’ve got any doubts, switch to a payroll system that doesn’t accrue leave and stores annual leave in weeks.

This article first appeared on BusinessDesk.