How is final pay calculated?

Final Pay (definition)

An employee’s Final Pay is processed slightly differently to a normal pay. On top of the regular worked hours or salary, employees are entitled to:

Any annual leave and alternative holidays still owing - any annual leave that has been taken in advance will be deducted.

Payment for public holidays that occur if the employee were to take any outstanding leave.

8% of their gross earnings since their last annual leave anniversary date.

Any other lump sum or payments owed e.g. redundancy payment

Employees who have been receiving Holiday PAYG are eligible for alternative days, but not any annual leave or public holidays.

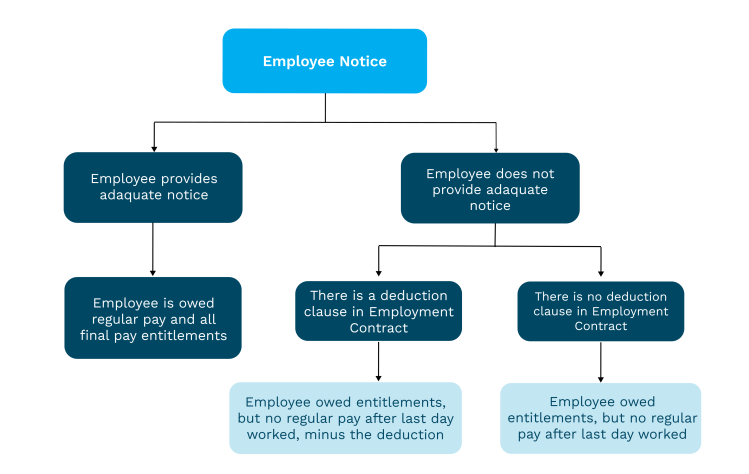

It’s important to note that when an employee gives notice will effect their final pay:

What an employee is taxed may look different to an average pay, as any leave payments in a Final Pay is taxed as an Extra Pay (Lump Sum Payment).

Pulling together a Final Pay can be a pain. In our payroll system, simply create a pay as normal, select ‘Set as Final Pay’ and PayHero will include what’s needed and let the IRD know.

Related Definitions

Related Resources

Find a payroll expert or get started today

14 Days Free · First Pay Walkthrough · No Credit Card Required