Payroll & Finance

6 things to look for when choosing a payroll system for your startup

September 19, 2016

There are so many NZ payroll software systems on the market these days that it’s become a bloody nightmare to get your head around all the different features, benefits and pricing structures.

If you’re an early stage startup founder in the process of bringing on staff, I’m guessing you don’t have much time to conduct a detailed payroll software comparison.

With that in mind here are a few tips to help you choose the right startup payroll software:

1. It’s not going to mess with your cashflow

While you’re trying to get your business off the ground, you might be tempted by a fully managed payroll service that takes care of all the details. That includes actually withdrawing funds from your bank account to pay your staff and Inland Revenue.

Sounds good, right? Maybe not. In the early days there is no greater concern for a small business than cashflow. While the idea of managed payroll might appeal, there are two major impacts on your business cashflow:

As well as paying your staff on payday, full-service payroll companies will also take your PAYE at the same time. Your PAYE isn’t actually due until the 20th of the following month, so you’ll be paying it anywhere between 20 and 50 days earlier than you need to!

Many payroll companies require a letter of credit. This means the bank will guarantee to pay your payroll company even if you don’t have sufficient funds in your account (and you’ll need to provide some sort of security to your bank). If this is the case you’ll also be looking at a set up fee of around $250 and an ongoing fee of about 1% per annum. Find out more about how payroll letters of credit can severely impact on your cashflow.

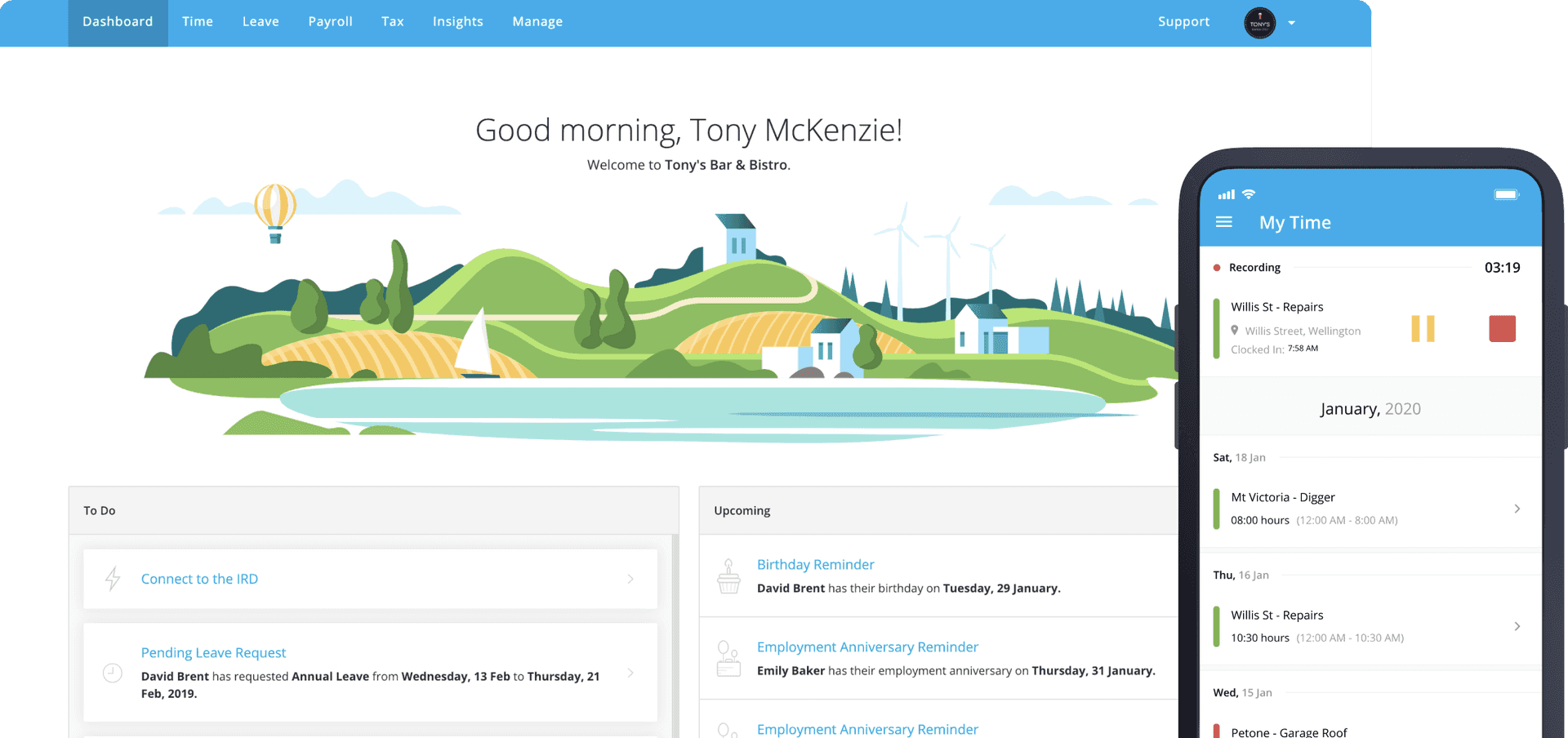

2. Payroll software that’s so easy you don’t need to think about it

We live in a busy world and startup founders are busier than most. Heck, I know a few that don’t always remember to eat.

Because these founders are juggling so many balls and wearing pretty much every hat in their business, online payroll for startups needs to be as easy as possible. You should be able to create a pay run, pay your staff and send them payslips, automatically send the data to your accounting system and have a cup of coffee in less than 5 minutes.

3. It easily handles part time, casual staff and contractors

So you need to bring in some outside expertise to help your business scale, but you can’t afford to take people on full time? I hear ya.

The good thing is you’ve got options. Depending on your requirements you could look to take on staff on a part time, casual or contract basis. The only downside is that these scenarios make payroll and leave more complex, and many payroll software systems don’t handle this complexity particularly well.

Look for a payroll system that lets staff enter online timesheets so you have a record of the days and hours they’ve worked. Then your online payroll software knows an employee’s average daily rate, which makes calculating annual leave and public holidays infinitely easier.

Even better, you may be able to automate public holiday calculations by using timesheet patterns to determine whether a public holiday was an otherwise working day for an employee.

4. It provides value for money

We’ve already touched on the importance of cashflow in the early days of your startup. The pricing of the best NZ payroll software systems varies considerably, as does the functionality of the software. The key thing is to do your research and make sure you’re comparing apples with apples. Not all systems have the same features or level of service. Sometimes it's worth paying a bit more for better quality software if it’s going to save you significant time and effort each month.

5. It will grow with your business

Look for a payroll system that charges you for the number of employees you are paying. Then you’re only paying for what you need and that will continue to be the case as your business grows.

Depending on the type of business you have, you may want to start with simple payroll and then at a later point have the option to start using more advanced features such as rosters or a photo timeclock.

6. You get great support

Importantly, you’re going to want a payroll system that provides outstanding support so you can trust that you’ll get the right advice when you need it. Look for a provider with an in-depth help centre, and free email and phone support with a support team based in New Zealand. Messing up people’s pay is not the best way to earn employee loyalty and build a winning startup culture.