Payroll & Finance

A Guide to Payday Filing in New Zealand

What is payday filing?

As part of Inland Revenue’s (IRD) Making Tax Simpler initiative, payday filing was made mandatory in April 2019. As the name suggests, payday filing means submitting PAYE returns to IRD after each pay, rather than once a month. The due date for paying PAYE and other deductions to IRD remains unchanged.

What are the benefits of payday filing?

The main benefit is the ability to file returns automatically from your payroll software, integrating it into your normal payroll cycle. This eliminates the need to store payroll information and remember to file PAYE separately at the end of the month.

More up-to-date information allows IRD to calculate taxes and entitlements more accurately, ensuring that companies and employees pay and receive the correct amounts throughout the year.

Does PayHero support payday filing?

Absolutely. Here at PayHero, we always favour technology solutions over time-consuming manual processes. We worked with IRD for months building and testing integration functionally and were among the very first payroll providers to go live with payday filing. You can trust that reporting to IRD is fully integrated into the system.

How does payday filing work?

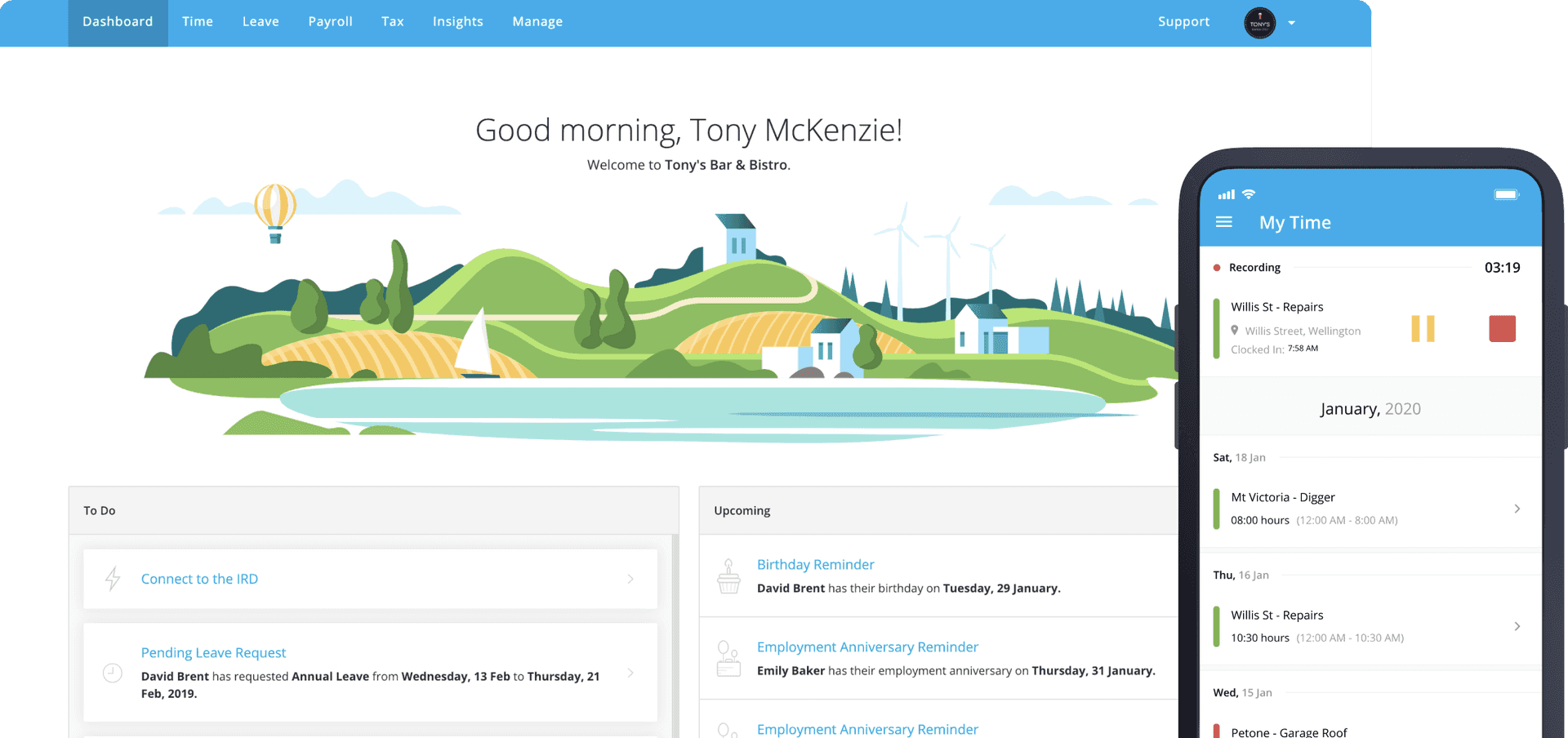

Online payroll systems like PayHero can connect directly to IRD’s software to submit tax returns. Once your account is connected to IRD, each time you send a pay run, the PAYE details will automatically be sent to the IRD. If your employees are paid wrong, it’s also easy to fix up in PayHero.

For PayHero users, paying IRD at the same time as employees is a setting turned on by default. This means all your pay and tax obligations are taken care of on payday. If this setting is turned off, you will need to pay your PAYE by the 20th of each month.

How do I connect my PayHero account to IRD?

To set up automatic Payday Filing with PayHero, you'll need to connect your PayHero account to your company's myIR account. Go to Manage > Integrations and click Connect next to Inland Revenue.

If you have further questions about payday filing in PayHero, please email support@payhero.co.nz.