Payroll & Finance

ACC Payroll and Business FAQs

February 19, 2023

FAQ Index:

How much are the ACC levy rates?

How do the levy rates get paid?

Bonus… What about ACC payments for self-employed earners?

How are ACC levy payments taxed?

What is first week compensation?

Do employees’ annual leave entitlements change while on ACC?

Does ACC affect an employee’s anniversary date?

What about ACC and sick leave?

What happens if the employee doesn't come back to work after unpaid ACC absence?

How does ACC work with payroll?

About ACC

What is the ACC scheme?

Accident Compensation Corporation (ACC) is a scheme where every person in New Zealand is covered if they are injured in an accident. ACC is partly paid for by the government, and partly by businesses, employees and self-employed workers who pay levies. Essentially, when an employee is injured, ACC covers a portion of their wages while the employee recovers on ACC leave.

What does the ACC not cover?

What ACC covers is decided on by parliament. Currently, ACC does not cover any illnesses, age-related conditions or emotional difficulties. To be eligible for the ACC scheme, your injuries must be caused by an accident.

Paying ACC Levies

How much are the ACC levy rates?

There are three different ACC levy rates - Earners’ Levy, Work Levy and the Working Safer Levy. The ACC levy rates change every year and come into effect from 1 April.

The current rates for 2024/2025:

Earners’ Levy - $1.60 per $100 (including GST).

Work Levy - Varies between businesses. Find an estimate here.

Working Safer Levy - $0.08 per $100.

The ACC annual maximum deduction threshold is $142,283 with the maximum levy payable $2,276.52.

How do the levy rates get paid?

All employers pay a Work Levy and Working Safer Levy to ACC. The Work Levy helps cover injuries that happen at work, and the Working Safer Levy is to support and fund Worksafe NZ. ACC issues an invoice to employers using the income and payroll details from IRD after filing their tax return.

Employees contribute to the Earners’ Levy, which is included in their PAYE deduction from their wages. This covers injuries that occur during non-work activities. Employees will see this come out of their income.

Bonus… What about ACC payments for self-employed earners?

Self-employed contractors pay the Earners’ Levy, Work Levy and Working Safer Levy. You will be invoiced once a year, normally in July or August, after taxes have been filed. The Work Levy amount depends on your liable earnings and the type of work you do, with higher rates where the risk of injury is greater.

How are ACC levy payments taxed?

The Earners’ Levy for self-employed earners is non-taxable as this covers non-workplace accidents. Employers can claim on the Work Levy and Working Safer Levy, with the exception being the earner premium payable by shareholders in a company.

Processing ACC for Employees

What is first week compensation?

When paying your employees during the first week post injury, there are two scenarios:

If it’s a non-work injury, the employee may request sick or annual leave to cover the days they do not work during the first week.

If it’s a work related injury, as their employer, you are obligated to pay first week compensation at the rate of 80% of the employee’s regular income, see how to calculate here.

After the first week, ACC will continue the payments at the same rate of 80% if weekly compensation is requested and approved through MyACC.

Do employees’ annual leave entitlements change while on ACC?

Employees’ leave entitlements don’t change if they’re receiving ACC payments. ACC absences are considered part of an employee’s continuous employment, so leave is calculated as if the employee was still working for you.

Does ACC affect an employee’s anniversary date?

ACC is considered continuous employment, so it shouldn't affect the employment anniversary date or any of the employee’s entitlement dates.

Is ACC included in PAYE?

For your employees, they pay an ACC earner’s levy and will see this come out of their income, alongside their income tax (PAYE). This is generally rolled into the total tax amount to pay, so you likely won’t see it as a separate item on employee payslips.

For those who are self-employed, ACC will need to be paid in addition to your income tax, and you will receive this as an invoice from ACC, with how much ACC to pay depending on your industry.

What about ACC and sick leave?

ACC and sick leave work the same as ACC and annual leave. An employee on an ACC absence should continue to get their full leave entitlements.

Employees may use their sick leave while on the ACC Weekly Compensation scheme to top up their income from 80% to 100% if the employee and employer agree to do so.

How do employees claim ACC?

If an employee is injured in an accident, the first step is going to get treated by a medical provider. From there, the treatment provider will submit a claim to the ACC scheme on your behalf. If your claim is covered, ACC will contact you to let you know. You can then advise ACC of what financial support you need, including transport to and from medical appointments or help around the home. If you need weekly compensation because you are unable to work, ACC will cover up to 80% of your income while you recover. This is not automatic, and you will need to apply for this on MyACC.

How do ACC top ups work?

Employers and employees can agree to top up the remaining 20% of the employee’s wages using the employee’s sick leave. If the employee has sufficient sick leave, they may request you pay them 1 day of sick leave per week as an ACC top up payment. For employees working less than 5 days per week, the Sick Leave top up should be 20% of their regular earnings. If the employee has no sick leave left, they may choose to use annual leave instead. The employer cannot force the employee to do so.

Some employers will choose to pay the 20% from their own pocket, not the employee’s leave entitlements.

If you're topping up an employee's earnings, the employee might need to be taxed at secondary tax rates. Your employee should check this, and complete an IR330 tax code declaration form if needed.

What happens if the employee doesn't come back to work after unpaid ACC absence?

When an employee ends their employment after being on an ACC absence, the employer must pay the employee any outstanding annual leave entitlements, as would normally happen in a final pay. ACC compensation payments are not considered earnings, and therefore not part of the employee’s gross income. But the ‘first week compensation’ paid by the employer is included in an employee's gross earnings.

Special attention may be required, as extended periods of unpaid ACC leave may significantly reduce the rates, or zero them completely. While this may be correct, if the employee's Ordinary Weekly Rate before they went on ACC leave can be manually calculated and is higher than their Average Weekly Rate, this should be used instead.

Payroll and ACC - The Bottom Line

How does ACC work with payroll?

No matter what payroll system you use, there are some general rules to follow with the ACC scheme:

When the employee is taking leave for the first week of a non-work related accident, sick leave may be used.

If an employee has a work-related accident, the employer has to pay “first week compensation” and cannot require the employee to take that time off as sick leave.

If an employee is receiving “first week compensation” for a work-related accident, an employer and employee can agree that the employer will top up the “first week compensation” payment from 80% to 100% by reducing the employee’s sick leave entitlement by one day for every five days’ leave taken.

If an employee has a work-related or non-work-related accident and remains on weekly compensation, the employer cannot require the employee to take time off as sick leave.

If an employee is receiving weekly compensation from ACC, the employer has no obligation to pay the employee.

Where the period of leave on ACC is in excess of five days (for either workplace or non-work accidents), the employer and employee can agree that the employer will top up the ACC payment from 80% to 100% by reducing the employee’s sick leave entitlement by one day for every five days’ leave taken.

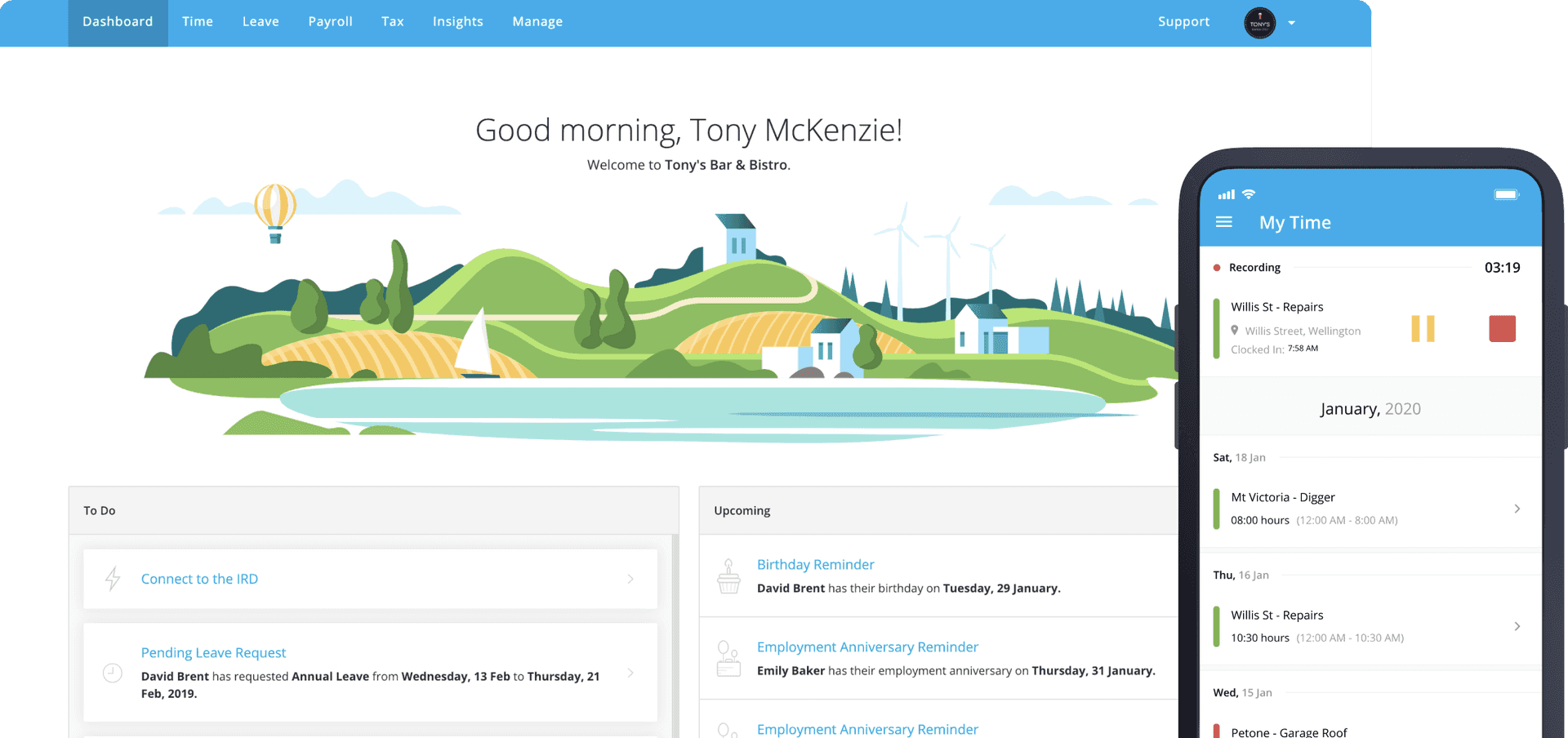

Record your ACC accurately

Keep your payroll record-keeping tidy with our award winning payroll software. PayHero manages ACC payments through Leave Requests and Pay Items. You can set up appropriate pay items to make ACC processing a breeze. Employees can also request leave through PayHero’s employee portal to cover ACC top ups.

If that sounds good to you, discover what PayHero has to offer and sign up for a 14 day free trial.

To learn more about processing ACC payments in PayHero, check out our super helpful support guide.