Payroll & Finance

2022 April Payroll Changes

February 22, 2022

The end of the financial year is fast approaching, and with that comes some important payroll and tax changes. If you're a New Zealand employer, take note that from 1 April 2022 the Minimum Wage, ACC Earners Levy and Student Loan Deduction rates and thresholds will all change.

Minimum Wage Changes - April 2022

Employees earning the minimum wage can expect to be paid $1.20 more an hour as the minimum wage jumps from $20.00 to $21.20 per hour. Over 300,000 workers in New Zealand will be directly affected by this jump, making an extra $2,500 a year.

The training and starting-out minimum wage will also increase from $16 to $16.96 per hour.

These changes are effective for any hours worked from 1 April 2022.

If you have employees on the minimum wage, starting-out wage or training wage, make sure you update their pay rate in your payroll system. If you’re using PayHero, it’s easy to change pay rates, even in the middle of a pay period. Check out the details here. PayHero’s Minimum Wage Top Up feature will automatically factor in the minimum wage increase.

ACC Earners Levy

From 1 April 2022 Kiwi employers will be taking a little more out of their employees wages to cover the ACC Earners Levy. This change also applies if you’re self-employed, a shareholder-employee or contractor.

ACC Earners’ levies will increase from $1.21 per $100 to $1.27. With GST this new levy is effectively $1.46 in every $100, or 1.46%.

PayHero users won’t need to change anything manually in the system, we do it all for you. However, if you’re paying employees using automatic payments set up directly with your bank, you’ll need to adjust these to accommodate the new rates. This isn’t necessary if you’re using PayHero’s Pay Now or Bank Batch files.

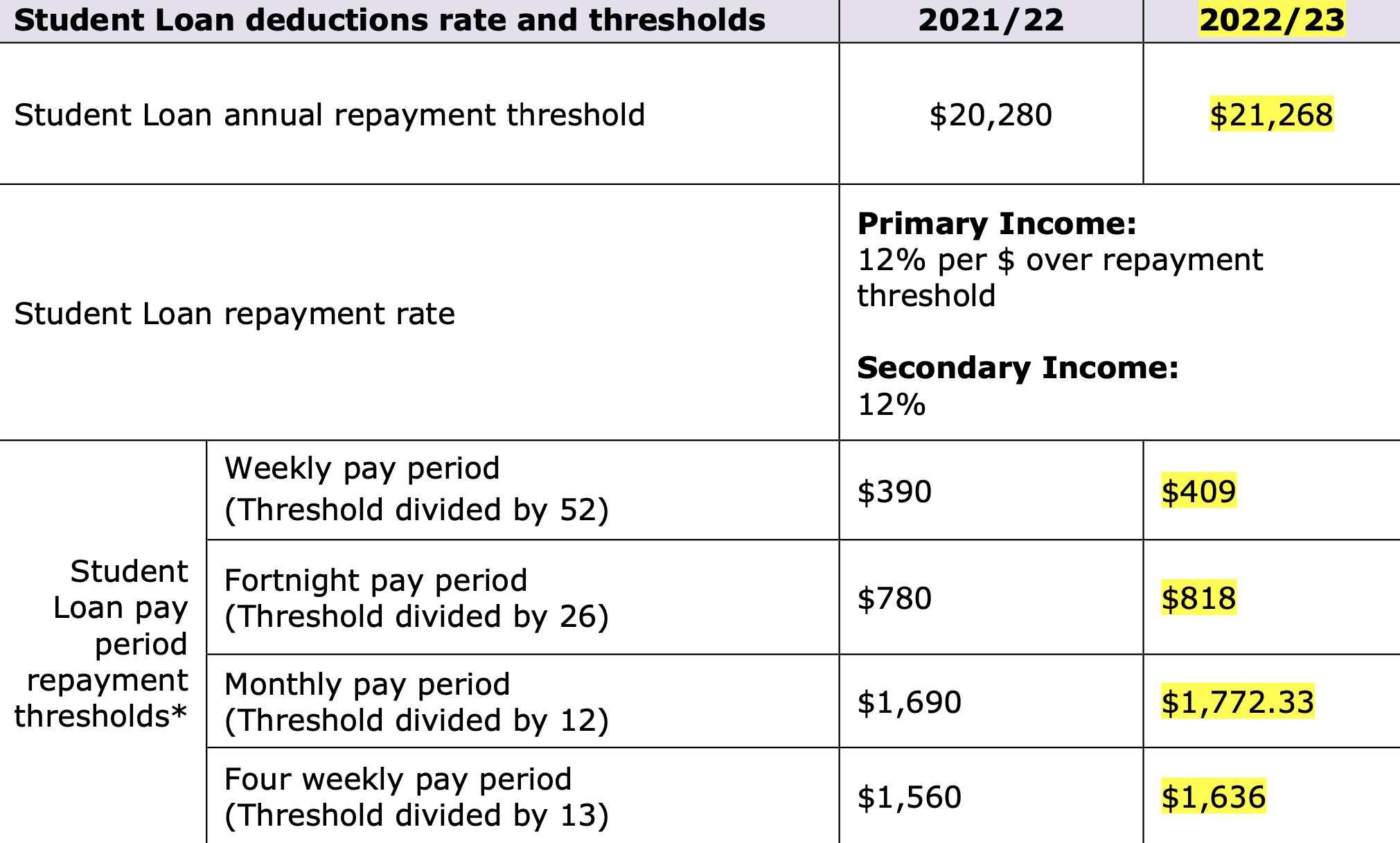

Student Loan Deduction Rates and Thresholds

Some Kiwis with student loans will gain a few more dollars on their paycheck before paying off their student loan. The student loan repayment threshold will increase by $988 from $20,280 to $21,268 on 1 April 2022.

PayHero will automatically calculate student loan deductions if an employee has been set-up with a tax code ending in 'SL'. The Student Loan Repayment pay item will be added to any applicable employees default pay items and deduct the appropriate amount when they are included in a Pay Run.